Types of Free Car Insurance Coverage

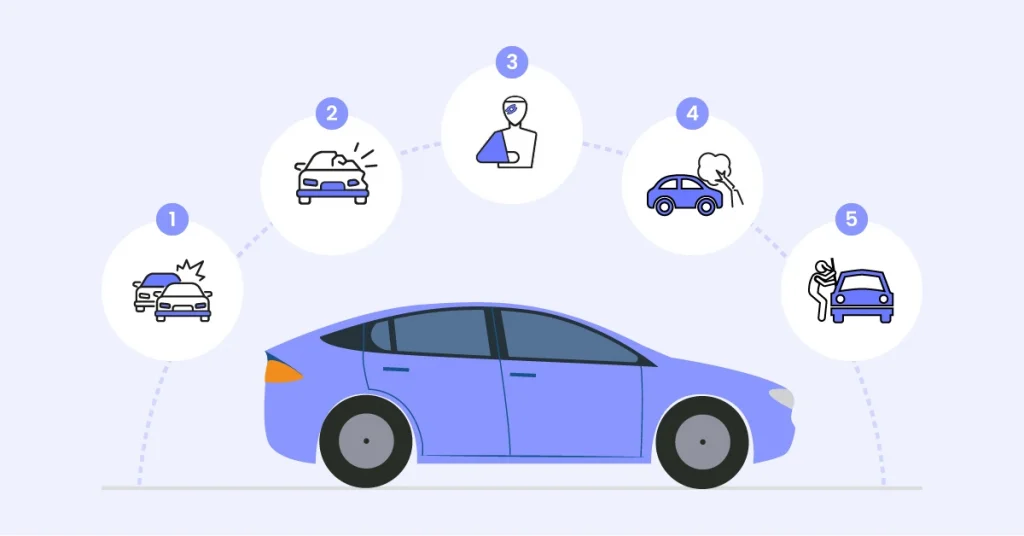

When it comes to Free Car Insurance in USA, there are several types of coverage available. These include liability coverage, which pays for damages to other vehicles or property in an accident, as well as collision coverage, which covers damage to your own vehicle. Additionally, comprehensive coverage can protect against non-accident-related damage, such as theft or vandalism.

Requirements for Free Car Insurance

To qualify for Free Car Insurance in USA, you'll typically need to meet certain requirements set by the insurance provider. These may include maintaining a clean driving record, having a certain level of income, or meeting other eligibility criteria. Be sure to check with different insurance companies to see what options are available to you.

Compare Free Car Insurance Quotes

When shopping for Free Car Insurance in USA, it's important to compare quotes from multiple providers to ensure you're getting the best deal. Look for policies that offer the coverage you need at a price you can afford, and don't be afraid to negotiate with insurance agents to find discounts or special offers.

How to Apply for Free Car Insurance

Applying for Free Car Insurance in USA is a relatively straightforward process. Start by researching different insurance companies and their coverage options, then gather the necessary documents, such as proof of income and driving history. Once you've chosen a policy, simply fill out an application either online or in person.

Common Misconceptions About Free Car Insurance

Despite its benefits, there are some common misconceptions about Free Car Insurance in the USA. For example, many people believe that free coverage means limited protection or higher premiums down the line. However, this isn't necessarily the case, and it's important to separate fact from fiction when considering your insurance options.