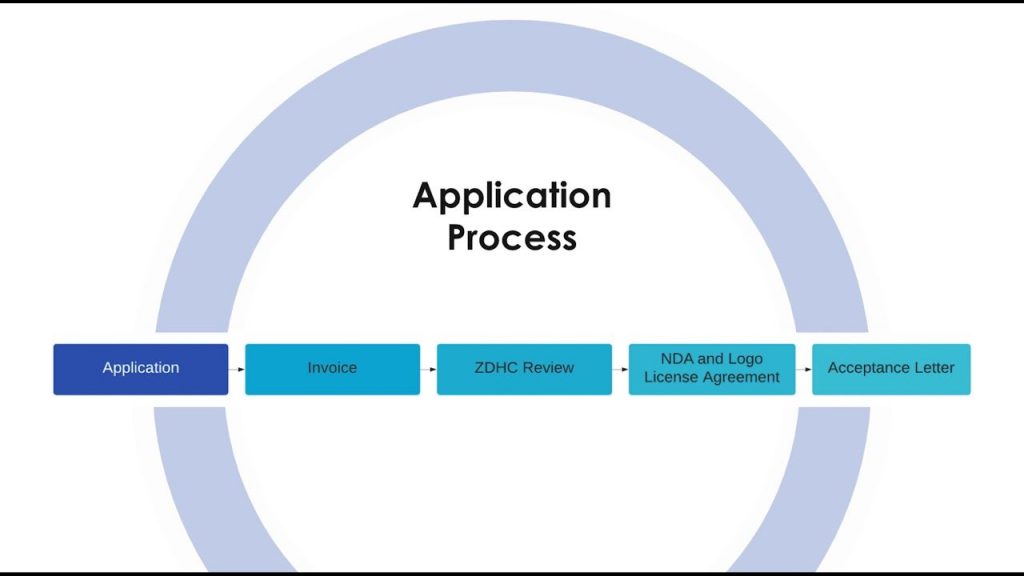

The Application Process

Gathering Necessary Documentation:

To apply for life insurance, you'll need to provide personal information, such as your age, health history, and lifestyle habits. Additionally, you may be required to undergo a medical exam and provide financial documentation, such as income verification and asset statements.

Completing the Application:

Once you've gathered the necessary documentation, complete the insurance application accurately and honestly. Be prepared to answer questions about your medical history, lifestyle habits, and family medical history to ensure the insurer assesses your risk accurately.

Underwriting and Approval:

After submitting your application, the insurance company will review your information and determine your insurability. This process, known as underwriting, evaluates factors such as your age, health status, and lifestyle habits to determine your risk classification and premium rate.