Beat the Market: Proven Strategies for Successful Investing

In the dynamic realm of investing, mastering strategies to outperform the market is a perpetual pursuit. Successful investors navigate through market fluctuations with adeptness, employing strategies honed through experience and knowledge. This comprehensive guide illuminates proven methodologies, equipping you with the insights needed to beat the market and achieve enduring success in your investment endeavors.

Understanding Market Dynamics

In this section, we delve into the fundamental principles governing market behavior and explore actionable insights for capitalizing on market dynamics.

Investment experts emphasize the importance of comprehending market dynamics before formulating investment strategies. Markets are influenced by a myriad of factors, including economic indicators, geopolitical events, and investor sentiment. By understanding these dynamics, investors can make informed decisions that enhance their investment performance.

Crafting a Diversified Portfolio

Crafting a diversified portfolio lies at the core of successful investing. Diversification mitigates risk by spreading investments across various asset classes, industries, and geographic regions. In this section, we elucidate the significance of diversification and provide practical guidelines for constructing a well-balanced portfolio that withstands market volatility.

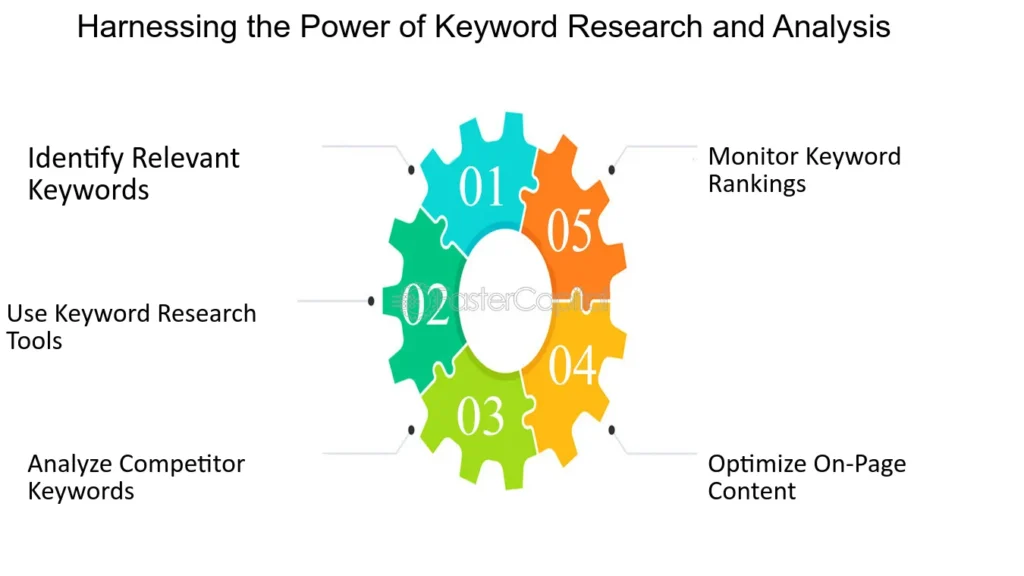

Harnessing the Power of Research and Analysis

Research and analysis serve as indispensable tools for investors seeking to gain a competitive edge. By conducting thorough research and employing analytical techniques, investors can uncover lucrative opportunities and mitigate potential risks. This section delves into effective research methodologies and analytical tools, empowering investors to make data-driven investment decisions.

Leveraging Technology for Investing

In today’s digital age, technology plays a pivotal role in revolutionizing the investment landscape. From algorithmic trading to robo-advisors, technological innovations offer investors unprecedented access to markets and resources. This section explores the transformative impact of technology on investing and elucidates how investors can leverage technological advancements to optimize their investment strategies.

Navigating Market Volatility with Confidence

Market volatility is an inherent aspect of investing, presenting both challenges and opportunities for investors. In this section, we discuss strategies for navigating market volatility with confidence, including maintaining a long-term perspective, staying informed, and adhering to a disciplined investment approach.

Achieving success in investing requires a steadfast commitment to continuous learning and adaptation. By implementing proven strategies and staying abreast of market developments, investors can enhance their likelihood of outperforming the market and attaining their financial goals.

FAQs

Beating the market entails employing a combination of strategies, including diversification, thorough research, disciplined investing, and staying informed about market dynamics.

While consistently outperforming the market is challenging, investors can increase their chances of success by adhering to sound investment principles and staying disciplined in their approach.

Risk management is crucial in beating the market as it helps investors mitigate potential losses and preserve capital during periods of market volatility.

Investors can leverage technology by utilizing analytical tools, algorithmic trading platforms, and robo-advisors to optimize their investment strategies and enhance portfolio performance.

Common mistakes include succumbing to emotional decision-making, chasing short-term gains, neglecting diversification, and failing to conduct thorough research.

Staying informed about market developments is paramount as it enables investors to make timely and well-informed decisions, thereby enhancing their ability to beat the market.

Conclusion

In conclusion, mastering the art of beating the market requires a combination of knowledge, discipline, and strategic acumen. By adhering to proven strategies, staying informed, and embracing technological advancements, investors can position themselves for success in the dynamic world of investing.