Boost Your Credit Score: Simple Steps to Improve Your Financial Standing

In today’s financial landscape, your credit score plays a pivotal role in shaping your financial opportunities. Whether you’re looking to secure a loan, rent an apartment, or even land your dream job, a healthy credit score can open doors to a myriad of possibilities. However, for many individuals, navigating the world of credit scores can be daunting. Fear not! In this comprehensive guide, we’ll delve into actionable steps to boost your credit score and enhance your overall financial well-being. Let’s embark on this journey towards financial empowerment together.

Understanding Credit Scores

Your credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. It’s calculated based on various factors, including your payment history, credit utilization, length of credit history, new credit accounts, and credit mix. A higher credit score indicates lower credit risk, making you more attractive to lenders.

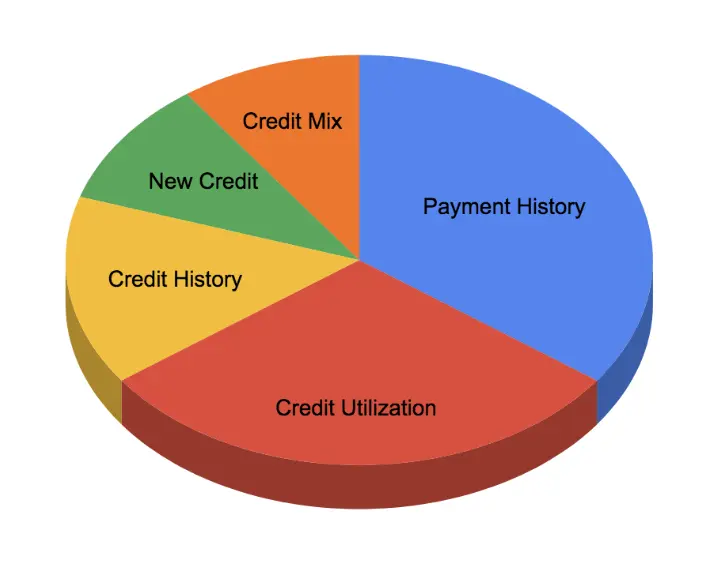

What Determines Your Credit Score?

Understanding the components that influence your credit score is crucial for improving it effectively. Here’s a breakdown of the key factors:

- Payment History: Your track record of making timely payments on credit accounts.

- Credit Utilization: The ratio of your credit card balances to your credit limits.

- Length of Credit History: The average age of your credit accounts.

- New Credit Accounts: The number of recently opened accounts and credit inquiries.

- Credit Mix: The variety of credit accounts you possess, such as credit cards, loans, and mortgages.

Simple Steps to Boost Your Credit Score

Now that we’ve grasped the fundamentals, let’s explore actionable steps to elevate your credit score:

Establish a Solid Payment History

Your payment history holds significant weight in determining your credit score. Aim to make timely payments on all your credit accounts, including credit cards, loans, and utility bills. Set up automatic payments or reminders to ensure you never miss a due date.

Reduce Credit Card Balances

High credit card balances can negatively impact your credit utilization ratio, leading to a lower credit score. Strive to keep your credit card balances low relative to your credit limits. Consider paying off outstanding balances or consolidating debt to lower your utilization ratio.

Increase Credit Limits

Requesting a credit limit increase can decrease your credit utilization ratio, potentially boosting your credit score. However, exercise caution to avoid overspending with higher credit limits.

Diversify Your Credit Mix

Having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, can demonstrate responsible credit management. Consider diversifying your credit portfolio over time to strengthen your credit profile.

Limit New Credit Applications

Frequent credit inquiries can signal financial distress to lenders, potentially lowering your credit score. Minimize new credit applications unless necessary, and space out credit inquiries over time.

Monitor Your Credit Report Regularly

Stay vigilant by monitoring your credit report regularly for inaccuracies or fraudulent activities. Report any discrepancies to the credit bureaus promptly to safeguard your credit score.

FAQs

It’s advisable to check your credit score at least once a year to monitor your financial health and identity theft.

Closing a credit card can affect your credit utilization ratio and average account age, potentially lowering your credit score. Consider keeping the card open if it doesn’t incur annual fees.

While paying off collections can positively impact your credit score, the collection account will still appear on your credit report for several years. Focus on establishing positive credit habits moving forward.

Most negative information, such as late payments, collections, and bankruptcies, can remain on your credit report for up to seven years. However, the impact on your credit score lessens over time.

Applying for multiple credit cards simultaneously can result in multiple hard inquiries, potentially lowering your credit score. Focus on responsible credit management rather than pursuing a high number of credit accounts.

Improving your credit score requires patience and discipline. While there are no overnight solutions, consistent adherence to healthy credit habits can lead to gradual score improvements over time.

Conclusion

Boosting your credit score is not an insurmountable task; it’s a journey towards financial empowerment and stability. By implementing these simple steps and staying committed to responsible credit management, you can elevate your credit score and unlock a world of financial opportunities. Remember, small actions today can yield significant rewards tomorrow. Take charge of your financial future and embark on the path to a brighter tomorrow.