Budgeting Made Easy: Painless Tips to Save More Money

In today’s fast-paced world, managing finances can often feel overwhelming. However, with the right strategies in place, budgeting can become a painless and even enjoyable process. In this comprehensive guide, we’ll explore practical tips and techniques to help you save more money effortlessly.

Understanding the Importance of Budgeting

Budgeting lays the foundation for financial stability and success. By creating a budget, you gain insight into your spending habits and can make informed decisions about where to allocate your funds. Moreover, budgeting allows you to prioritize your financial goals and work towards achieving them systematically.

Budgeting is not about restriction; rather, it’s about empowerment. By taking control of your finances, you can reduce stress, build wealth, and create a secure financial future for yourself and your loved ones.

Setting SMART Financial Goals

To effectively manage your finances, it’s essential to establish clear and achievable goals. SMART goals are Specific, Measurable, Achievable, Relevant, and Time-bound. Whether your objective is to save for a down payment on a house, pay off debt, or build an emergency fund, setting SMART goals provides a roadmap for success.

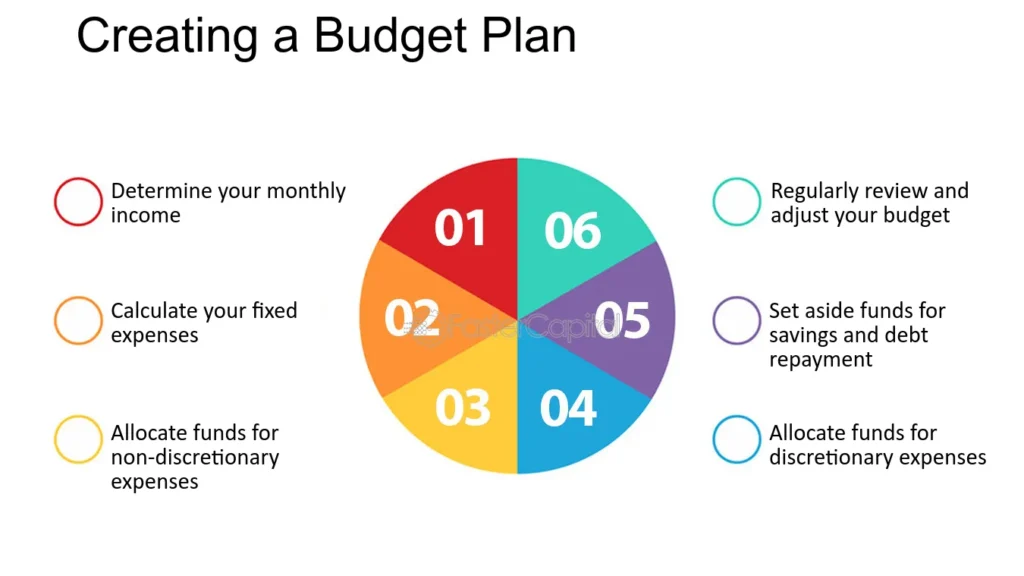

Creating a Detailed Budget Plan

A detailed budget plan serves as your financial blueprint, guiding your spending and saving decisions. Start by tracking your income and expenses to identify areas where you can cut back or reallocate funds. Allocate a portion of your income towards savings and investments to ensure long-term financial security.

Embracing Frugal Living

Embracing frugal living doesn’t mean sacrificing your quality of life; it’s about making conscious choices to prioritize what truly matters. Look for ways to reduce discretionary expenses, such as dining out less frequently, opting for generic brands, and finding free or low-cost entertainment options.

Leveraging Technology for Budgeting

Technology has revolutionized the way we manage our finances, making budgeting more accessible and convenient than ever before. Take advantage of budgeting apps and tools that automate expense tracking, provide real-time insights into your financial health, and offer personalized recommendations for saving money.

Building an Emergency Fund

An emergency fund serves as a financial safety net, providing peace of mind and protection against unexpected expenses or income disruptions. Aim to save at least three to six months’ worth of living expenses in an easily accessible account to cover any unforeseen circumstances.

Investing Wisely for the Future

Investing is a crucial component of long-term wealth building. Explore different investment options, such as stocks, bonds, mutual funds, and real estate, based on your risk tolerance and financial goals. Diversify your investment portfolio to minimize risk and maximize returns over time.

Prioritizing Debt Repayment

Debt can be a significant obstacle to financial freedom. Prioritize debt repayment by focusing on high-interest loans or credit card balances first. Consider debt consolidation or refinancing options to lower interest rates and accelerate your path to becoming debt-free.

Implementing practical strategies can make budgeting feel like second nature. Here are some painless tips to help you save more money effortlessly:

Automate Your Savings: Set up automatic transfers from your checking account to your savings or investment accounts to ensure consistent saving habits.

Track Your Spending: Use apps or spreadsheets to monitor your expenses and identify areas where you can cut back or adjust your budget.

Negotiate Bills: Contact service providers to negotiate lower rates on your utilities, insurance, or subscription services to reduce monthly expenses.

Meal Planning: Plan your meals in advance, create a grocery list, and avoid impulse purchases to save money on food expenses.

Comparison Shop: Compare prices online or use price comparison apps before making purchases to find the best deals and discounts.

Sell Unwanted Items: Declutter your home and sell items you no longer need or use to generate extra income.

FAQs

Consistency is key to successful budgeting. Try setting reminders, using budgeting apps, or involving an accountability partner to stay on track.

Yes, saving money is still achievable, even with limited income. Start by setting aside a small percentage of each paycheck and gradually increase your savings rate over time.

It depends on your individual financial situation. In most cases, it’s beneficial to establish an emergency fund first, then focus on debt repayment while continuing to save simultaneously.

Consider exploring opportunities for side hustles, freelancing, or investing in professional development to increase your earning potential.

Review your budget and identify areas where you can temporarily reduce spending to cover the unexpected expenses without derailing your financial goals.

Regularly review your budget, ideally on a monthly basis, to track your progress, make necessary adjustments, and ensure alignment with your financial goals.

Conclusion

Budgeting doesn’t have to be complicated or restrictive. By implementing these painless tips and strategies, you can take control of your finances, save more money, and achieve your financial aspirations. Remember, small changes can lead to significant results over time. Start today and embark on your journey towards financial freedom.