Demystifying ETFs and Mutual Funds: Choosing the Right Investment Vehicle

Investing in the financial market can be daunting, especially when faced with the choice between Exchange-Traded Funds (ETFs) and Mutual Funds. Each option comes with its own set of advantages and considerations. In this detailed guide, we’ll navigate through the complexities of ETFs and Mutual Funds, shedding light on their differences, benefits, and how to make an informed decision tailored to your investment objectives.

Understanding ETFs and Mutual Funds

Investors often encounter the dilemma of choosing between ETFs and Mutual Funds. Both are popular investment vehicles offering diversified portfolios, but they operate differently.

ETFs: The Versatile Investment Option

ETFs, or Exchange-Traded Funds, are a type of investment fund traded on stock exchanges. They encompass a variety of assets, such as stocks, commodities, or bonds, and are designed to track the performance of a specific index.

Investors are attracted to ETFs for their low expense ratios, tax efficiency, and flexibility in trading throughout the day, similar to individual stocks.

Mutual Funds: Traditional Investment Vehicles

Mutual Funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Managed by professional portfolio managers, Mutual Funds aim to achieve specific investment objectives.

Unlike ETFs, Mutual Funds are priced once a day at the market close, and investors buy or sell shares directly from the fund company at the net asset value (NAV) price.

Comparing ETFs and Mutual Funds: Pros and Cons

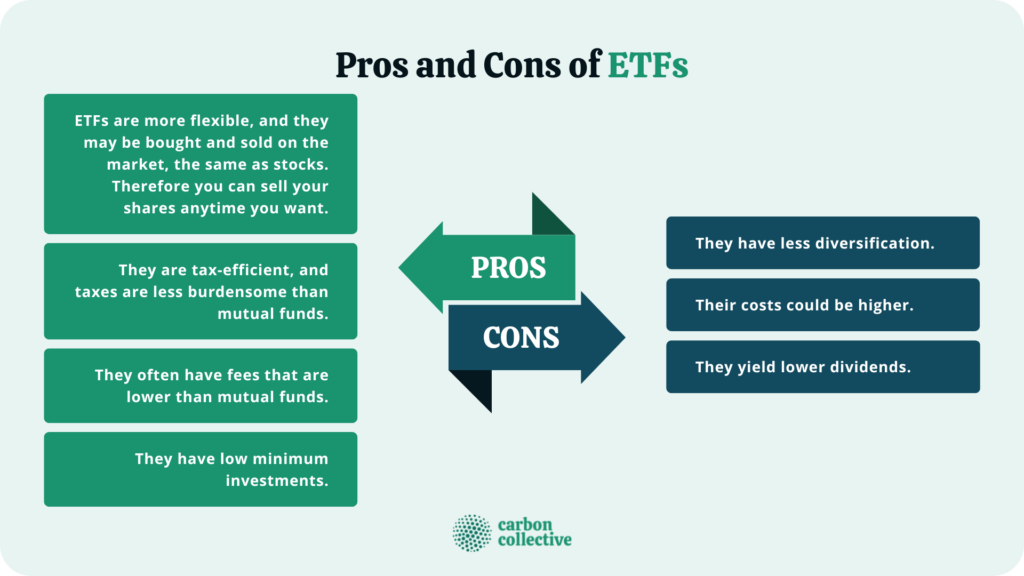

ETFs:

Pros:

- Liquidity: ETFs trade on exchanges like stocks, providing liquidity and flexibility to investors.

- Diversification: Investors gain exposure to a wide range of assets within a single investment.

- Tax Efficiency: Due to the unique structure, ETFs typically generate fewer capital gains, resulting in tax advantages.

Cons:

- Brokerage Commissions: Frequent trading of ETFs may incur brokerage fees, impacting overall returns.

- Intraday Price Fluctuations: Continuous trading exposes investors to intraday price volatility.

Mutual Funds:

Pros:

- Professional Management: Experienced portfolio managers handle investment decisions, offering peace of mind to investors.

- Automatic Reinvestment: Dividends and capital gains are automatically reinvested in the fund, maximizing returns.

- No Transaction Fees: Mutual Funds typically do not charge fees for buying or selling shares directly with the fund company.

Cons:

- Higher Expenses: Mutual Funds may have higher expense ratios compared to ETFs, affecting overall returns.

- Lack of Intraday Trading: Investors cannot trade Mutual Fund shares throughout the day, potentially missing out on market opportunities.

Investors often grapple with the decision of whether to invest in ETFs or Mutual Funds. Understanding the nuances of each investment vehicle is crucial in making an informed decision aligned with your financial goals.

Factors to Consider When Choosing Between ETFs and Mutual Funds

Investment Goals:

Your investment objectives play a pivotal role in determining whether ETFs or Mutual Funds are better suited for your portfolio. Consider factors such as risk tolerance, investment horizon, and desired returns.

Expense Ratings:

Compare the expense ratios of ETFs and Mutual Funds to assess the cost-effectiveness of each option. Lower expense ratios translate to higher net returns for investors over time.

Trading Flexibility:

Evaluate your trading preferences and frequency. If you prefer intraday trading and flexibility, ETFs might be more suitable. Conversely, if you prioritize long-term investing and are comfortable with less frequent trading, Mutual Funds could be a better fit.

Tax Considerations:

Understand the tax implications associated with ETFs and Mutual Funds. While ETFs are known for their tax efficiency, Mutual Funds may incur capital gains distributions, impacting taxable income.

Risk Management:

Assess the risk profiles of ETFs and Mutual Funds in relation to your investment strategy. Diversification, asset allocation, and risk tolerance are key factors to consider in mitigating investment risk.

Historical Performance:

Review the historical performance of ETFs and Mutual Funds to gauge their track record in various market conditions. Past performance is not indicative of future results, but it provides valuable insights into the fund’s management and strategy.

FAQs

ETFs are traded on exchanges throughout the day like stocks, while Mutual Funds are priced once a day at the market close and traded directly with the fund company.

Expense ratios represent the annual fees charged by ETFs and Mutual Funds for managing the fund. Lower expense ratios result in higher net returns for investors.

Yes, investors can diversify their portfolio by allocating funds to both ETFs and Mutual Funds based on their investment strategy and objectives.

ETFs are known for their tax efficiency due to the unique structure of creation and redemption of shares, which minimizes capital gains distributions compared to Mutual Funds.

Yes, Mutual Funds automatically reinvest dividends and capital gains back into the fund, compounding returns over time.

It’s advisable to review your investment portfolio periodically, typically every six months to a year, to ensure alignment with your financial goals and market conditions.

Conclusion

In conclusion, navigating the landscape of ETFs and Mutual Funds requires careful consideration of various factors, including investment goals, expense ratios, trading flexibility, tax implications, risk management, and historical performance. By understanding the distinctions between these investment vehicles and evaluating their suitability in relation to your financial objectives, you can make informed decisions to optimize your investment portfolio for long-term growth and wealth accumulation.