Emergency Savings Essentials: Preparing for Life’s Unexpected Events

In today’s unpredictable world, having a robust emergency savings fund is not just a luxury but a necessity. Whether it’s an unforeseen medical expense, a sudden job loss, or a major home repair, having a financial safety net can provide peace of mind and stability during turbulent times. In this comprehensive guide, we’ll delve into the essential steps to prepare for life’s unexpected events and build a solid emergency savings fund that can weather any storm.

Understanding Emergency Savings Essentials

Emergencies can strike at any moment, making it crucial to have a financial cushion to fall back on. Let’s explore the key components of emergency savings essentials:

Assessing Your Current Financial Situation

Before embarking on your emergency savings journey, it’s essential to take stock of your current financial situation. Evaluate your income, expenses, debts, and existing savings to determine how much you can realistically set aside for emergencies.

Setting Realistic Savings Goals

Establishing realistic savings goals is the cornerstone of building an emergency fund. Aim to save at least three to six months’ worth of living expenses to cover essential costs such as rent, utilities, groceries, and insurance premiums.

Creating a Dedicated Emergency Fund

To prevent temptation and ensure your emergency savings remain untouched, consider opening a separate savings account specifically earmarked for emergencies. Opt for a high-yield savings account that offers competitive interest rates while keeping your funds easily accessible.

Automating Your Savings

Take advantage of automation tools offered by banks and financial institutions to streamline your savings process. Set up automatic transfers from your checking account to your emergency fund on a monthly basis to ensure consistent contributions.

Building Financial Resilience

In addition to traditional savings accounts, explore other avenues for building financial resilience, such as investing in low-risk assets like bonds or certificates of deposit (CDs). Diversifying your savings portfolio can provide added stability and potential growth opportunities.

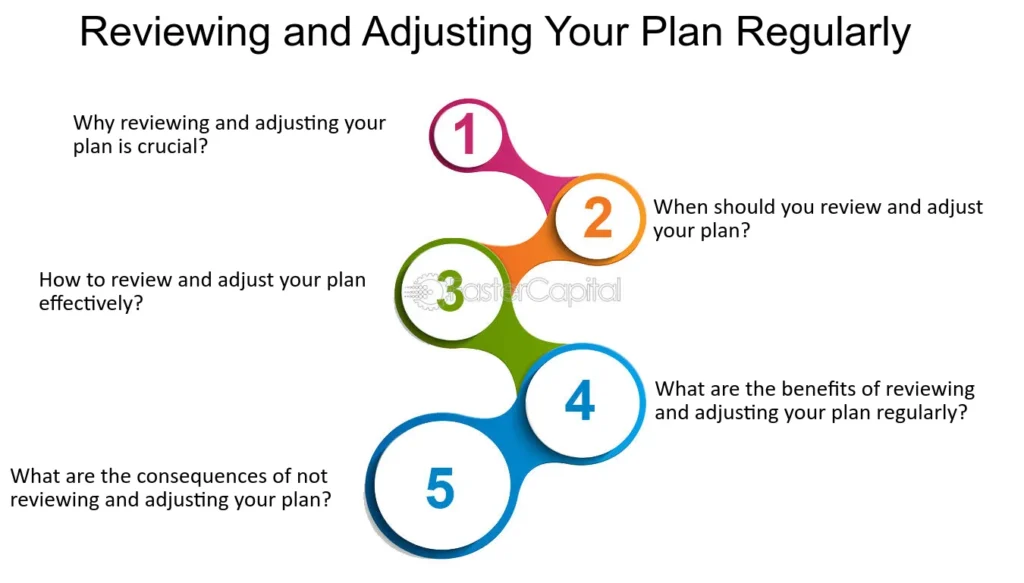

Reviewing and Adjusting Your Plan

Regularly review your emergency savings plan to ensure it remains aligned with your financial goals and current circumstances. Life changes, such as marriage, parenthood, or career advancements, may necessitate adjustments to your savings strategy.

Seeking Professional Guidance

If you’re unsure where to start or need personalized advice, don’t hesitate to consult with a financial advisor. A professional can offer tailored recommendations based on your unique financial situation and help you navigate complex financial decisions.

Building Community Support

In times of crisis, having a strong support network can make all the difference. Reach out to friends, family members, or community organizations for emotional support, practical assistance, or temporary financial aid if needed.

FAQs

Aim to save at least three to six months’ worth of living expenses to cover essential costs during emergencies.

It’s advisable to prioritize safety and liquidity over potential returns when allocating funds for emergencies. Consider low-risk investment options such as bonds or CDs for added stability.

Emergency expenses encompass unforeseen events that threaten your financial stability, such as medical emergencies, job loss, car repairs, or home repairs.

It’s recommended to review your emergency savings plan at least annually or whenever significant life changes occur to ensure it remains relevant and effective.

While it’s tempting to dip into your emergency savings for non-urgent expenses, it’s crucial to preserve these funds for genuine emergencies to maintain financial security.

Start small by setting achievable savings goals and gradually increasing your contributions over time. Consider cutting unnecessary expenses or exploring additional income streams to bolster your savings efforts.

Conclusion

By prioritizing emergency savings essentials, you can safeguard your financial future and navigate life’s unexpected twists and turns with confidence. Remember, it’s never too late to start building your emergency fund. Take proactive steps today to prepare for tomorrow’s uncertainties and enjoy greater peace of mind along the way.