Investing Mistakes to Avoid: Protecting Your Hard-Earned Cash

Investing is a journey filled with opportunities and pitfalls. While the potential for growth is enticing, it’s crucial to navigate the terrain carefully to protect your hard-earned cash. In this comprehensive guide, we’ll explore the common mistakes investors make and how to avoid them, ensuring a secure financial future.

Understanding Risk and Diversification

Diving into investments blindly is a common mistake many beginners make. Risk Assessment: Before investing, it’s imperative to assess your risk tolerance. Understand how much risk you’re comfortable with and tailor your investments accordingly. The Importance of Diversification: Putting all your money into a single investment is a recipe for disaster. Diversification spreads risk across various assets, safeguarding your portfolio from significant losses.

Research Before Investing

Many investors fall into the trap of following the crowd without conducting proper research. Due Diligence: Before committing your money, thoroughly research the investment opportunity. Analyze the company’s financial health, growth prospects, and industry trends. Avoiding Fads: Don’t be swayed by market hype or the latest trends. Invest based on sound fundamentals rather than fleeting fads.

Setting Realistic Goals

Without clear goals, it’s easy to veer off track and make impulsive decisions. Goal Setting: Define your investment objectives, whether it’s saving for retirement, purchasing a home, or funding education. Establish realistic timelines and benchmarks to measure progress. Staying Disciplined: Stick to your investment plan even during market fluctuations. Emotions can cloud judgment, leading to costly mistakes.

Monitoring and Adjusting

Investing is not a set-it-and-forget-it endeavor. Regular monitoring and adjustments are essential. Regular Check-Ins: Monitor your investments periodically to ensure they align with your goals and risk tolerance. Rebalancing: As market conditions change, rebalance your portfolio to maintain diversification and risk levels.

Avoiding High Fees

High fees can eat into your returns over time, significantly impacting your wealth accumulation. Fee Awareness: Be mindful of the fees associated with various investment products, including mutual funds, ETFs, and brokerage accounts. Seeking Low-Cost Options: Opt for low-cost investment vehicles such as index funds and ETFs to minimize expenses and maximize returns.

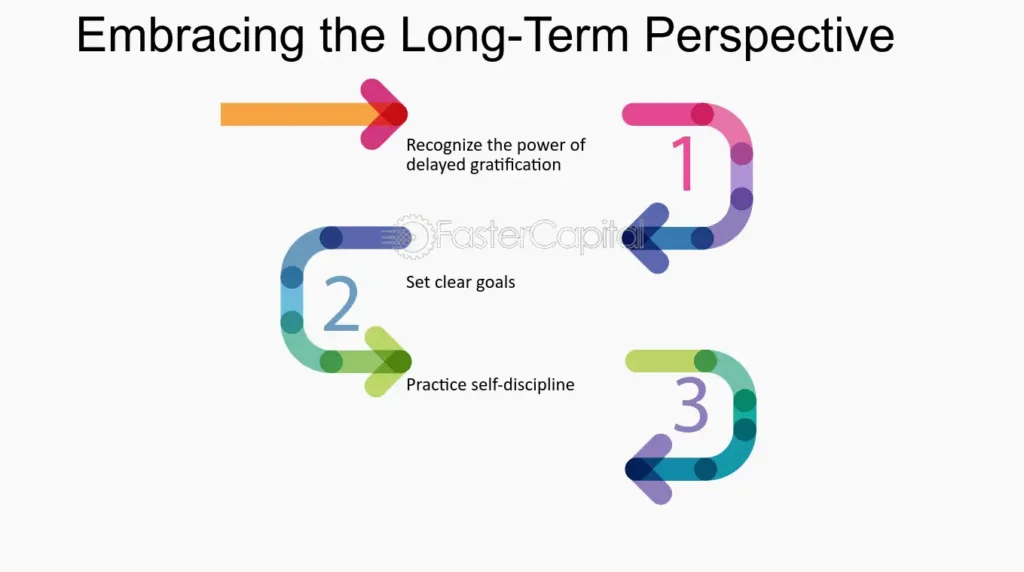

Embracing Long-Term Perspective

Investing is a marathon, not a sprint. Patience Pays Off: Adopt a long-term perspective and resist the urge to chase short-term gains. Stay focused on your goals and avoid making impulsive decisions based on market volatility. Compounding Benefits: Harness the power of compounding by staying invested and reinvesting dividends over time.

Seeking Professional Guidance

Navigating the complexities of the financial markets can be daunting, especially for novice investors. Financial Advisor Consultation: Consider seeking guidance from a qualified financial advisor who can provide personalized investment advice tailored to your needs and goals. Educational Resources: Take advantage of educational resources, seminars, and workshops to enhance your investment knowledge and skills.

Avoiding these common investing mistakes can safeguard your hard-earned cash and set you on the path to financial success. By assessing risk, conducting thorough research, setting realistic goals, monitoring your investments, minimizing fees, embracing a long-term perspective, and seeking professional guidance, you can navigate the investment landscape with confidence and achieve your financial objectives.

FAQs

Failing to diversify exposes your portfolio to concentrated risk, meaning a downturn in a single asset could have significant repercussions on your overall wealth.

It’s recommended to review your portfolio at least annually, although some investors opt for quarterly or semi-annual check-ins, especially during periods of market volatility.

While the allure of quick gains may be tempting, investing in trendy assets carries inherent risks. It’s crucial to conduct thorough research and assess long-term viability before investing.

While some individuals successfully manage their investments independently, seeking professional guidance can provide valuable insights and peace of mind, especially for complex financial matters.

Look for low-cost investment options such as index funds and ETFs, and be mindful of brokerage fees and expense ratios when selecting investment products.

During market downturns, it’s essential to stay calm and avoid making impulsive decisions. Stick to your long-term investment plan and consider opportunities to rebalance your portfolio.

Conclusion

Protecting your hard-earned cash requires diligence, discipline, and a strategic approach to investing. By avoiding common pitfalls, conducting thorough research, setting realistic goals, and seeking professional guidance when needed, you can navigate the investment landscape with confidence and achieve financial success.